Kasasa Loan

It's time to look at loans differently.

Get a great rate with the Kasasa Loan®,

the only loan with Take-Backs.

You know it’s smart to pay off your loan faster. But what if you need that money later?

When your loan has Take-Backs, you have options. Apply for a Kasasa Loan today, and get 11.85% APR up to 5 years.

Traditional Loan

Kasasa Loan

Competitive loan terms

Get the amount you need upon approval, with a set interest rate and payoff schedule.

Traditional Loan

Kasasa Loan

Pay extra to shorten loan term

Anything over the minimum payment goes toward the loan principal to help you pay it off early and save on interest.

Traditional Loan

Kasasa Loan

Access your Take-Back® balance when you need it

Withdraw the extra cash you've paid at any time. Funds are transferred into your designated account, and your balance and pay-off schedule adjust accordingly. The interest rate never changes.

Traditional Loan

Kasasa Loan

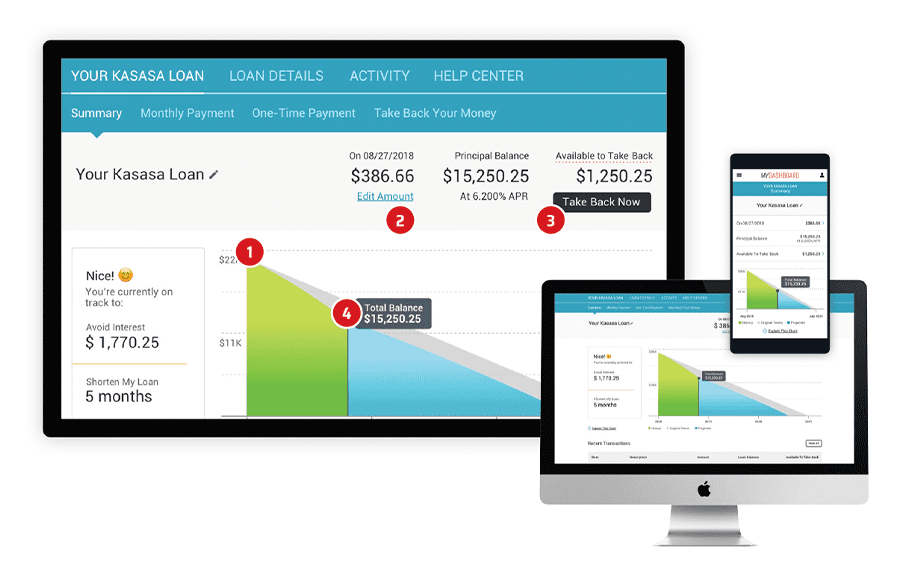

Stay in control with your personal online dashboard

See where you stand easily, make extra payments, and access the extra money you've paid anytime, anywhere. No complicated tables sent to you in the mail.

Traditional Loan

Kasasa Loan

Disclosure

*Rate Subject to change. Up to 5 year term 11.85% APR: 60 monthly payments of $22.17 per $1,000 borrowed.

A Kasasa Loan is a fixed rate, fixed term loan that provides consumers with an opportunity to lower their overall interest expense or create an open-end, revolving line of credit, by making payments that are in excess of the loans scheduled monthly payments. Unlike traditional personal loans, consumers who have met each of their required scheduled payments, can borrow against these excess funds at the same interest rate as their initial Kasasa Loan to address unexpected needs (i.e. car repairs, health issues) or take advantage of opportunities (i.e. college acceptance) that may arise. The loan’s current available credit limit will be specified in each periodic statement issued.

Additional Information: To qualify, a borrower must be at least 18 years old, a U.S. citizen or a permanent resident and must meet our institution’s underwriting requirements. Rates and terms are subject to change at any time without notice and are subject to state restrictions. Contact one of our Universal Bankers for additional information, details and loan application.

Kasasa and Kasasa Loans are trademarks of Kasasa, Ltd., registered in the U.S.A. “Take back banking” is a trademark of Kasasa Ltd., registered in the U.S.A.

Ready To Get Started

Finally, a loan that’s built for real life.

When you have extra cash, you can pay extra to get ahead (and save on interest)…and if you need that extra cash later, you can get it back! Noworries, no penalties. Your rate stays the same and your payoff schedule automatically adjusts.

Pay ahead and save on interest

Easily pay off your loan faster and reduce interest costs.

Access the extra cash anytime, for free.

Additional payments are always available to withdraw, with no worries or penalties.

Stay in control of your loan.

The simple interface shows the impact of changes before you make them.

Your loan, on your terms.

With a Kasasa Loan, you always know exactly where you stand and can easily project the impact of any changes...before you make them.

![]()

Choose to pay the minimum monthly payment and pay off your loan as projected.

![]()

Anytime you want, put extra funds (e.g. Christmas bonus or tax refund) toward your balance to get ahead and save on interest.

![]()

If life throws you a curveball — unexpected car repairs, the “need” for a sudden vacation — you can withdraw “take-back” funds.

![]()

The funds are transferred into your account, and your loan balance and payoff schedule automatically adjust to reflect the change.